15+ how to get a loan to open a bar

The loan terms benefit both the lender and borrower and the eligibility requirements are straightforward. Write a Business Plan and State Where the Business Loan is going.

Get Nightclub And Bar Business Loans For Bad Credit

There are a variety of options you might want to explore including.

. Search for these opportunities around the area where you want to. Citizens to get a bar study loan with a US. Not all bar loans are created equal.

But depending on whether youre choosing. You may be able to get a loan from the Small Business Administration SBA or from private lenders. A bar business loan is any type of small business loan that will be used specifically for starting renovating or buying a drinking establishment.

Here are some ways that people open bars without money to set it up and operate it at first. 7 Types of Bar Loans. How to Compare Bar Loans.

Business lines of credit A business. 1To get a loan for a bar you will need to have good credit and collateral. Funding Your New Bar Through SBA Loans.

If youre asking yourself if you can get a loan to open a bar the answer is a clear yes. As a bar or club owner the SBA 7 a has several benefits. The main point to remember when preparing to get a business loan for a restaurant or bar is to ensure that these three items are presented well.

There are tons of options for financing your bar. The first step that you should take when it comes to finding funding for your bar is to search for grants online. Benefit from these Bar Study Loan features.

Note that crowdfunding is usually only ideal for opening a bar for the first time repairing your bar after a major disaster or for other big one-time purchases. The 7a Loan Program is SBAs primary program for helping start-up and existing small businesses with financing guaranteed for a variety of general business. It works out to 51 payments of 2500 119 payments of 16206 and one payment of 12023 for a Total Loan Cost of 2068037.

Lower your total loan costget a 025 percentage point interest rate reduction when. On Sallie Maes website. The funds are sent directly to you.

Citizens Bank allows non-US. Small Business Association SBA loans are among the best ways to get funding for a bar let alone any other kind of. Nonetheless here is a detailed guide to put you through the process of getting startup loan from your business.

Here are some of the features you will want to compare when. This type of loan can be short-term. Term loans are offered by banks.

1 the borrower 2 the business. Investors The most popular way to open a bar with no money is to pitch the idea to. Take control of your funds.

It also offers multiple loan terms a maximum repayment schedule of 10 years and co. You would compare a bar loan in the same fashion you would any other loan.

15 Affordable Batangas Beach Resorts You Should Book

Capital One Adds Plaza Premium Lounges To Its Airport Lounge Network

Financing Education In The Caribbean Countries

Bar Business Loans Finding Getting One Lantern By Sofi

Sudan Sd Prevalence Of Hiv Total Of Population Aged 15 49 Economic Indicators Ceic

Blog Fintech Forum Europe Since 2013 Award Winning Insights On What S Next In European Fintech From The Startups Investors And Financial Institutions Making It Happen

7 Ways To Finance Your Dream Bar Bevspot

How To Open A Bar Everything You Need To Know And Then Some

Why Does High Bar Squat Feel Easier Than Low Bar Squat Quora

Reclaim Payday Loans For Free Money Saving Expert

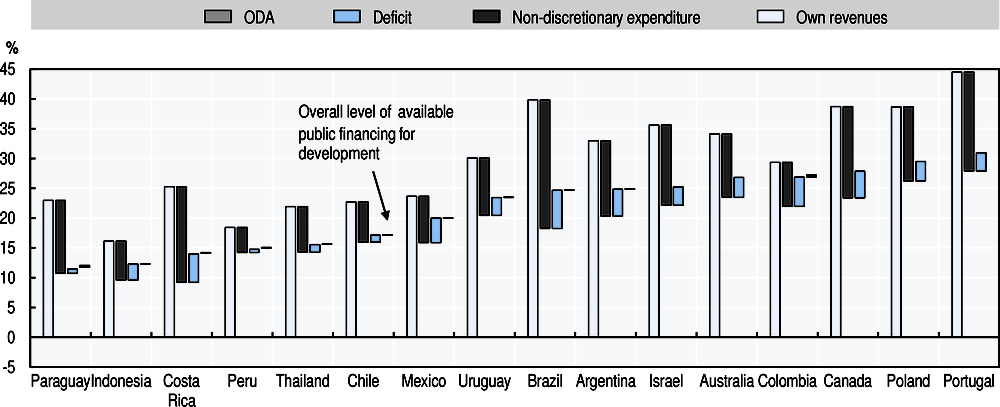

Immc Swd 282021 29290 20final Eng Xhtml 3 En Autre Document Travail Service Part1 V7 Docx

How To Get A Grant Or Loan To Open A Bar

Dreamxamerica Dreamxamerica Twitter

C4fiwvahrhx8om

Home Oecd Ilibrary

Fsa Conference Fsaconf Twitter

7 Ways To Finance Your Dream Bar Bevspot